C2C Advanced Systems Limited IPO Opens on November 22, 2024

Nov 21, 2024

PNN

Mumbai (Maharashtra) [India], November 21: C2C Advanced Systems Limited specialises in development of complex systems for defence, homeland security and aerospace sectors. It also delivers bespoke, cutting-edge solutions to all the arms of the defence forces involving integration of complex weapons and sensors. The company proposes to open its Initial Public Offering on November 22, 2024, aiming to raise Rs 99.07 Crore with shares to be listed on the NSE Emerge platform.

The issue size is 43,83,600 equity shares with a price band of Rs 214- Rs 226 Per Share and face value of Rs 10 each.

Equity Share Allocation

- QIB Anchor Portion - Not more than 12,49,200 Equity Shares

- Qualified Institutional Buyer - Not more than 8,32,800 Equity Shares

- Non-Institutional Investors - Not Less than 6,24,600 Equity Shares

- Retail Individual Investors - Not Less than 14,57,400 Equity Shares

* Market Maker - 2,19,600 Equity Shares

The net proceeds from the IPO will be utilized for Funding capital expenditure for upgrading the existing Experience Centre and setting up a Training Centre in Bengaluru, along with a new Experience Centre in Dubai, fit-outs at the new premises at both Bengaluru and Dubai, Payment of Security Deposit for the new premises at Bengaluru, Karnataka, India, working capital requirements, general corporate purpose and issue expenses. The anchor bidding will open on November 21, 2024 and the issue will close on November 26, 2024.

Mark Corporate Advisors Private Limited & Beeline Capital Advisors Private Limited are the Book Running Lead Managers to the Issue, while Link Intime India Private Limited is Registrar to the Issue.

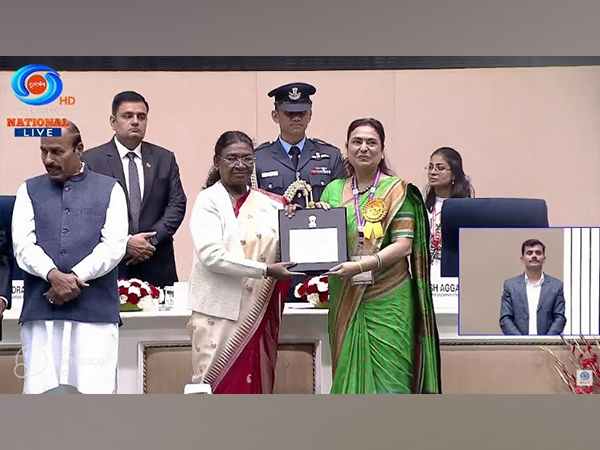

Lakshmi Chandra, Chairperson and Managing Director of C2C Advanced Systems Limited expressed, "As we prepare for our IPO, this milestone represents a transformative step in our journey as one of the leading provider of advanced technology solutions across defense, security, aerospace, and complex sensor integration domains. The growing emphasis by the government on indigenous equipment for the armed forces presents significant opportunities for our innovative offerings, and our ability to deliver reliable and secure systems positions us with a distinct competitive edge.

The funds will strengthen our working capital, providing financial flexibility to execute our strategic goals and enhance our client engagement and support our expanding customer base."

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same)